Discover the Essential Factors Shaping the Centurion Housing Market

Identify the Key Elements That Influence Property Values in Centurion

The Centurion housing market is shaped by a multitude of key factors such as location, the availability of amenities, and current market trends. Properties’ valuations are significantly influenced by their proximity to essential amenities, including schools, shopping centres, and public transport. For example, homes located near the bustling Centurion Mall or major transport routes tend to have higher price points due to the added convenience and accessibility they provide to residents.

Market dynamics, particularly the principles of supply and demand, play an integral role in determining the prices of properties. Recently, there has been a notable increase in the demand for entry-level homes from first-time buyers, largely influenced by the quest for affordability in a fluctuating economic landscape. Understanding these dynamics is crucial for making informed offers during negotiations, allowing you to present proposals that align with the true market value of a property.

Moreover, external economic factors such as interest rates and the overall economic climate have a significant impact on buyer sentiment. When interest rates decrease, a larger pool of potential buyers may feel incentivized to enter the market, which could increase competition and drive prices up. Conversely, during economic downturns, the market may soften, providing buyers with the opportunity to negotiate more favorable terms. Being aware of these factors enables you to approach negotiations with a strategic mindset, enhancing your chances of success.

Explore the Most Desired Features in Centurion’s Entry-Level Housing Market

Current trends in Centurion’s entry-level housing market highlight evolving buyer preferences and the rise of new developments. A growing number of buyers are now placing a premium on modern amenities and security features, evident in new complexes that offer gated access and shared facilities. These developments are particularly appealing to young professionals who seek a balanced lifestyle, accommodating both their work commitments and leisure activities.

Additionally, there is an increasing interest in eco-friendly living, which is shaping buyer decisions. Properties that incorporate energy-efficient designs or utilize sustainable materials are becoming more sought after, as they promise long-term savings and environmental advantages. Being aware of these trends can be advantageous as you prepare for negotiations, allowing you to identify properties likely to appreciate in value, thus giving you a competitive advantage in discussions.

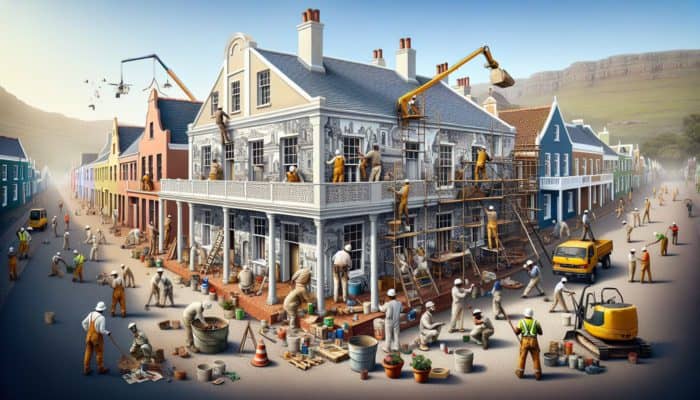

Furthermore, specific neighborhoods in Centurion, such as Lyttelton and Hennopspark, are undergoing revitalization. These areas, which were once undervalued, are gaining traction due to their central locations and community-driven initiatives. Familiarizing yourself with these evolving neighborhoods can provide valuable insights that enhance your negotiation strategies, enabling you to secure properties at lower prices before their values rise further.

Master the Art of Researching Local Property Values in Centurion

Conducting thorough research on local property values in Centurion is crucial for effective negotiations. Begin by analyzing recent sales data from credible property websites and estate agents. This information will provide you with insights into average prices in specific neighborhoods, helping you ascertain what constitutes a fair market offer.

Another effective strategy involves attending open houses and property viewings. Engaging with local estate agents can provide additional insights into market conditions and the histories of various properties. These professionals often possess unpublished information regarding upcoming sales and market fluctuations that can strengthen your negotiating position.

Utilizing local property reports is also a practical approach. Reports generated by property analysts can illuminate current market trends, forecast future developments, and pinpoint areas with growth potential. A comprehensive understanding of property values not only enhances your negotiating power but also instills increased confidence in your purchasing decisions.

Proven Techniques for Securing Exceptional Deals on Entry-Level Homes in Centurion

Identify the Optimal Times to Purchase Property in Centurion

Certain times of the year can present better buying opportunities within Centurion’s housing market. Generally, the late winter and early spring months are considered the most advantageous for buyers. During this timeframe, sellers may be more inclined to finalize deals before the bustling summer months arrive, leading to greater flexibility in negotiations.

- January to March: Post-holiday market, where sellers are often eager to sell.

- April to May: Pre-peak season, presenting opportunities for lower competition.

- August to September: Buyers typically return after winter, resulting in less competition.

- Late November to December: Sellers eager to close before the year-end.

It is essential to consider the unique characteristics of the local market. For example, in Centurion, seasonal shifts can significantly affect buyer behavior. During warmer months, families with children often prefer to relocate, which can result in increased competition. Therefore, timing your purchase during less competitive periods can empower you to negotiate more favorable terms.

Additionally, monitoring economic indicators is imperative. Significant changes, such as fluctuations in interest rates or new government housing policies, can have direct impacts on the housing market. By staying informed and strategically timing your purchase, you can enhance your negotiating power and secure a favorable deal.

Leverage Your Market Knowledge for Effective Negotiation

Utilizing your understanding of the Centurion housing market can significantly improve your negotiation outcomes. Familiarize yourself with local property trends, including average sale prices and the typical duration homes remain on the market in your chosen area. This knowledge equips you with the insights necessary to make competitive offers that accurately reflect the true market value.

Understanding the dynamics of supply and demand is equally vital. In periods of high demand coupled with limited inventory, sellers are more likely to maintain their asking prices. Conversely, in a buyer’s market, characterized by an oversupply of homes relative to buyers, you are likely to find more room for negotiation. Recognizing these conditions allows you to adapt your approach accordingly.

Moreover, pay attention to local economic factors. Economic conditions, such as employment rates and infrastructure developments, can greatly influence property values. By proactively researching these elements, you position yourself to negotiate effectively while identifying potential bargain opportunities before they capture the broader market’s attention.

Learn from Real-World Success Stories of Negotiations in Centurion

Real-world examples of successful negotiations in Centurion illustrate effective strategies that buyers can adopt. For instance, a first-time buyer in The Reeds successfully acquired a property below the asking price by conducting thorough research on comparable sales. Equipped with data, they confidently presented their offer, emphasizing that similar homes had sold for less, thereby strengthening their position.

Another compelling case features a buyer who identified a property that had been on the market for an extended period. They used this information during negotiations, suggesting that the seller might be more open to considering a lower offer given the length of time the property had remained unsold. Ultimately, this approach resulted in a successful purchase at a significantly reduced price, highlighting the importance of understanding market conditions.

Moreover, buyers who collaborate with local estate agents often find themselves at a distinct advantage. One buyer in Zwartkop partnered with a knowledgeable agent who had extensive insights into the local market. This agent was able to provide critical information about the seller’s motivations, enabling the buyer to craft an offer that resonated with the seller’s needs, ultimately leading to a successful negotiation.

Understand the Role of Local Estate Agents in the Negotiation Process

Local estate agents in Centurion play a crucial role in facilitating negotiations. Their extensive knowledge of the Centurion housing market equips them to provide valuable insights into pricing trends and local neighborhood dynamics. An agent’s expertise is essential in helping buyers comprehend the true value of a property and in determining how to position their offers appropriately.

Furthermore, agents often establish strong relationships with sellers and their representatives. This rapport can enhance communication during negotiations, allowing agents to advocate effectively on behalf of their clients. For instance, an agent might present a buyer’s offer highlighting their strengths, making it more appealing to the seller.

Moreover, local agents can assist in navigating counteroffers. Their experience in various negotiation scenarios enables them to advise clients on the most effective response strategies. They can help buyers stay composed and focused, guiding them in evaluating counteroffers against their original objectives and budget.

Strategies to Identify Undervalued Properties in Centurion

Identifying undervalued properties in Centurion can lead to significant savings and advantageous negotiations. Start by monitoring homes that have been on the market for an extended period. These properties may indicate a seller’s willingness to negotiate, especially if they have already adjusted their asking price.

Another important indicator is the condition of the property. Homes requiring minor cosmetic improvements, such as fresh paint or landscaping, may be undervalued compared to similar properties in better condition. Buyers who can envision the potential of such homes can negotiate effectively, using the necessary repairs as leverage to secure a more favorable price.

Additionally, consider the broader economic context. Areas undergoing revitalization or economic development may feature undervalued properties poised for appreciation. Investigating local developments and community initiatives can help you identify opportunities before they gain recognition in the market, positioning you to negotiate advantageous deals.

Essential Preparations for Effective Negotiations in Centurion

Prepare the Necessary Documentation Before Entering Negotiations

Having the right documentation ready is critical for streamlining the negotiation process in Centurion. One of the most important documents is proof of income, which validates your financial capability to purchase a home. Additionally, obtaining a pre-approval letter from a lender signals to sellers that you are a serious buyer, thereby enhancing your leverage during negotiations.

Other vital documents include bank statements and tax returns. These documents provide evidence of your financial stability and ability to meet mortgage obligations. Presenting these documents when making your offer can reassure sellers of your credibility, subsequently strengthening your negotiating position.

Consider also preparing a buyer’s profile. This profile can showcase your aspirations as a homeowner, especially if you plan to renovate or improve the property. Personalizing your approach can foster an emotional connection with sellers, potentially making them more inclined to negotiate favorably with you.

Establish a Realistic Budget for Your Home Purchase

Setting a realistic budget for acquiring a home in Centurion is crucial for successful negotiations. Begin by assessing your financial situation, taking into account your income, savings, and existing debts. This evaluation will assist you in determining how much you can comfortably afford without straining your finances excessively.

Understanding local market prices is equally important. Researching the average prices for entry-level homes in your desired neighborhoods will provide clarity on what to expect. This knowledge enables you to establish a budget that aligns with market realities, ensuring you do not overextend yourself during negotiations.

Furthermore, consider additional costs associated with homeownership. These may include property taxes, maintenance expenses, and insurance. Factoring in these elements can prevent unexpected financial strain, allowing you to negotiate more confidently within your established budget.

Enhance Effective Communication with Sellers

Effective communication with sellers in Centurion can significantly influence negotiation outcomes. Start by clearly outlining your intentions and offer, as ambiguity can lead to misunderstandings and hinder progress. Articulating the reasoning behind your offer can help sellers appreciate your perspective and understand your position better.

Respectful communication is equally vital. Maintaining a courteous tone, even during challenging negotiations, fosters a positive atmosphere that can lead to better terms. Building rapport with sellers by showing genuine interest in their property can also enhance your negotiating position.

Be responsive and timely in your communications. Delays in responding to offers or inquiries can create unnecessary tension and may prompt sellers to consider offers from other buyers. By being prompt and engaged, you convey your seriousness and commitment, leaving a positive impression.

Key Strategies for Successful Negotiation in Centurion

Implement Common Negotiation Tactics for Better Outcomes

Utilizing common negotiation tactics in Centurion can assist buyers in securing better deals on entry-level homes. One effective strategy is to start discussions with a lower offer. While it is essential to remain respectful, initiating with a lower price can pave the way for negotiations, allowing sellers to respond with counteroffers that may still fit within your budget.

Understanding the seller’s motivations is another useful tactic. If a seller needs to relocate quickly or is facing financial pressure, they may be more amenable to negotiating. Tailoring your offer to align with their circumstances can create a win-win scenario, thereby elevating your chances of success.

Lastly, be prepared to walk away. Holding firm to your budget conveys to sellers that you are a serious buyer who respects their financial limits. This confidence can facilitate favorable negotiations, prompting sellers to reconsider their terms to keep you engaged.

Strategize Your Approach to Counteroffers

Responding to counteroffers in Centurion requires a thoughtful approach. Start by carefully analyzing the seller’s counteroffer and understanding their position. Consider how their response aligns with your original budget and objectives, evaluating whether it represents a reasonable compromise.

Maintaining flexibility while remaining firm is essential. If their counteroffer falls within a negotiable range, be ready to adjust your offer accordingly. However, if it exceeds your budget, communicate your limitations clearly, reiterating your initial offer or presenting a revised one that stays within your financial capabilities.

Moreover, consider adding value to your response. If you cannot meet the seller’s counteroffer, explore other terms that may appeal to them, such as a quicker closing date or fewer contingencies. This approach can create a more attractive package for the seller, facilitating a successful negotiation.

Understanding the Value of Collaborating with Real Estate Agents During Negotiations

Real estate agents in Centurion are invaluable assets throughout negotiations. Their expertise and familiarity with the local market allow them to provide insights that can guide your negotiation strategy effectively. Agents understand pricing trends, and their knowledge can help you determine where to position your offers effectively.

Additionally, agents act as intermediaries. They can communicate your interests and concerns to the seller, providing a buffer that can ease tensions during negotiations. This professional representation fosters a more productive dialogue, enabling you to focus on your objectives while they manage the intricacies of the negotiation process.

Furthermore, their experience in negotiations enables agents to anticipate potential challenges. They can advise you on common pitfalls and help you navigate counteroffers, ensuring you remain strategically aligned throughout the entire process. Engaging a local estate agent is often a wise investment when negotiating in Centurion’s competitive housing market.

Optimize the Timing of Your Offers for Maximum Effectiveness

Strategically timing your offers in Centurion can greatly influence your negotiation success. Monitoring market trends and seasonal fluctuations is essential. For instance, if you notice that properties tend to remain on the market during specific months, you can time your offer to coincide with these periods, thereby increasing your negotiating leverage.

Moreover, consider current economic conditions. In a market where interest rates are rising, buyers may feel compelled to act swiftly, resulting in heightened competition. Conversely, if rates are stable or declining, you might discover more opportunities to negotiate, as sellers may be more receptive to offers. Timing your approach based on these dynamics can help you secure a better deal.

Additionally, pay attention to the seller’s timeline. If you know a seller is eager to close quickly due to personal circumstances, you can strategically position your offer. By aligning your timing with their needs, you can create a compelling case for why your offer stands out, thereby enhancing your chances of a successful negotiation.

Effective Strategies for Securing Outstanding Deals on Entry-Level Homes in Centurion

Utilize Proven Negotiation Techniques for Successful Outcomes

Proven negotiation techniques in Centurion can lead to successful outcomes for buyers. One effective strategy is to fully comprehend the seller’s timeline. If a seller needs to move quickly, emphasizing your readiness to close can make your offer more appealing, even if the price is lower than their asking price.

Making strategic concessions can also yield benefits. For example, if a seller expresses concerns regarding the closing timeline, offering flexibility in your own closing date can enhance their comfort and willingness to negotiate on price. This collaborative approach often results in mutually beneficial agreements.

Utilizing market data to substantiate your offers is another powerful technique. When presenting your offer, referencing comparable sales in the area can justify your price point. This data-driven approach instills confidence in your proposal and demonstrates your comprehensive understanding of the local market, making it difficult for sellers to dismiss your offer outright.

Incorporate Contingencies to Strengthen Your Negotiating Position

Incorporating contingencies into your offer can provide leverage during negotiations in Centurion. Common contingencies include home inspections and financing clauses. By including these in your offer, you establish an opportunity to withdraw if specific conditions are unmet, granting you more control during the negotiation process.

For instance, adding a home inspection contingency enables you to negotiate repairs or price reductions based on the findings. If significant issues arise during the inspection, you can use this information to request concessions from the seller, potentially lowering your purchase price or ensuring that repairs are completed before closing.

Moreover, financing contingencies safeguard you in case your mortgage does not materialize. This provides a safety net, allowing you to renegotiate or withdraw your offer without incurring financial penalties. Presenting a strong offer with well-defined contingencies can bolster your negotiating position while protecting your interests.

Steps to Ensure a Successful Closing of the Deal

Successfully closing a deal in Centurion involves several actionable steps to ensure a smooth transaction. First, confirm your financing. Ensure your mortgage approval is in place and that all financial documents are organized to avoid delays later in the process. This step is crucial for demonstrating your readiness to proceed with the purchase.

Conducting a thorough home inspection is another critical aspect. Engage a reputable inspector to assess the property for any hidden issues. If significant concerns arise, leverage the inspection report as a negotiation tool, allowing you to request repairs or a price reduction prior to finalizing the purchase.

Lastly, negotiate any last-minute repairs or conditions before closing. Proactively addressing any issues identified during the inspection ensures that both parties are satisfied with the final agreement. Following these steps will facilitate a smoother closing process, allowing you to transition into your new home with confidence.

Understanding the Benefits of Investing in Entry-Level Homes in Centurion

Recognize the Strong Investment Opportunities Offered by Entry-Level Homes

Entry-level homes in Centurion provide substantial investment potential for buyers. Their affordability makes them accessible to first-time buyers, while the possibility of property appreciation over time enhances their appeal as a long-term investment. In areas experiencing growth, these homes can appreciate in value, delivering solid returns on investment.

Additionally, entry-level homes often serve as stepping stones for future investments. As buyers build equity through monthly mortgage payments, they can leverage this equity for subsequent investments or upgrades. This ability to ascend the property ladder makes entry-level homes a strategic choice for those aiming to build wealth through real estate.

Furthermore, Centurion’s advantageous location bolsters the potential for value growth. Proximity to major employment hubs and ongoing infrastructure developments can drive demand, making entry-level homes a wise investment choice for individuals keen on entering the property market.

Explore the Benefits of Lower Maintenance Costs

One significant advantage of purchasing entry-level homes in Centurion is the lower maintenance costs associated with these properties. Many entry-level homes are relatively new, built to modern standards, which typically results in fewer repairs and lower upkeep costs compared to older properties.

Additionally, many entry-level houses come with warranties on major systems such as roofing and plumbing. These warranties can further reduce unexpected expenses, providing peace of mind for first-time buyers. This aspect makes homeownership more manageable, particularly for those adjusting to their new financial responsibilities.

Moreover, lower maintenance costs enhance the overall affordability of homeownership. With fewer funds allocated to repairs, buyers can invest more in their lifestyles or savings. This financial flexibility allows homeowners to enjoy their properties without the worry of unexpected repair bills, making entry-level homes an appealing option for many.

Understand How Entry-Level Homes Contribute to Equity Growth

Entry-level homes in Centurion are excellent vehicles for building equity. As buyers consistently make mortgage payments, they gradually reduce the principal balance, leading to increased ownership of the property over time. This accumulation of equity can serve as a valuable resource for future investments or home improvements.

Furthermore, if property values appreciate, the equity in a home can grow even faster. In thriving neighborhoods where demand is rising, homeowners may witness substantial increases in their property values, providing a robust financial foundation. This appreciation can facilitate future financing opportunities, allowing buyers to access funds for renovations or investments.

Additionally, buyers can enhance their equity by undertaking home improvements. Simple upgrades or renovations can boost a home’s value, further contributing to equity growth. This potential for both natural appreciation and value-added enhancements makes entry-level homes an appealing option for those looking to build wealth over time.

Foster Community Engagement Through Entry-Level Homes

Entry-level homes in Centurion often promote a strong sense of community. Many of these properties are situated in neighborhoods with active community initiatives, facilitating connections and engagement among residents. This communal spirit can enrich the living experience for new homeowners.

Access to local amenities is another factor that enhances community living. Entry-level homes are frequently located near schools, parks, and recreational facilities, encouraging family-friendly lifestyles and fostering social interactions. Having these amenities within easy reach can simplify residents’ participation in community events and activities.

Moreover, entry-level homes tend to attract a diverse demographic. Young families, professionals, and retirees alike may find these properties appealing, creating a vibrant neighborhood atmosphere. This diversity contributes to a welcoming and inclusive community, enhancing the overall living experience for all residents.

Benefit from Tax Advantages of Owning Entry-Level Homes

Owning entry-level homes in Centurion can provide several tax benefits that improve the overall cost-effectiveness of homeownership. One of the primary advantages is the ability to deduct mortgage interest on your annual tax return. This deduction can significantly reduce your taxable income, particularly in the early years of homeownership when interest payments are at their highest.

Homeowners can also deduct property taxes, offering further financial relief. These tax deductions can accumulate to substantial savings over time, making homeownership more financially viable and attractive, especially for first-time buyers.

Additionally, if you make energy-efficient upgrades to your home, you may qualify for extra tax credits. Many local governments provide incentives for homeowners who invest in green technologies, such as solar panels or energy-efficient appliances. These credits further enhance the investment potential of entry-level homes, making them an even more appealing option for prospective buyers.

Step-by-Step Guide Through the Closing Process in Centurion

Understand the Crucial Steps in the Closing Process

During the closing process in Centurion, buyers can expect several key steps that must be followed to finalize their purchase. The initial step involves reviewing and signing legal documents, including the sale agreement and mortgage documents. It is vital to thoroughly read through these documents to understand your obligations and rights as a buyer.

Next, be prepared to cover closing costs, which can include transfer fees, registration fees, and any applicable taxes. Anticipating these costs is essential to avoid any last-minute surprises that could jeopardize your purchase. Ensure you budget for these expenses in addition to your down payment to facilitate a smooth closing process.

Finally, once all documents are signed and payments have been made, you will receive the keys to your new home. This moment often represents the culmination of substantial effort and negotiation, marking the beginning of your journey as a homeowner. Understanding each step of the closing process can alleviate stress and ensure a successful transaction.

Handle Post-Purchase Negotiations with Care

Post-purchase negotiations in Centurion may arise if issues are discovered after moving in. Common occurrences include repairs that were not addressed before closing or discrepancies in property condition. It is crucial to remain proactive in addressing these matters as soon as they arise.

Begin by communicating openly with the seller or their agent. If issues were noted during the home inspection but were not resolved prior to closing, document these concerns and reach out to the seller to discuss potential remedies. A collaborative approach can lead to more amicable resolutions.

Additionally, retaining a professional inspector for further assessments can provide valuable insights. If significant repairs are needed, having a documented report can strengthen your case in negotiations for compensation or repair agreements with the seller. Being prepared and assertive in handling post-purchase negotiations can lead to satisfactory outcomes for all parties involved.

Ensure a Smooth Transition into Your New Home

Transitioning smoothly into your new home in Centurion requires careful planning and organization. Start by scheduling your move well in advance, allowing ample time for packing and loading your belongings. Hiring a reputable moving company can alleviate stress and ensure your possessions arrive safely at your new residence.

Setting up essential utilities prior to moving in is another critical step. Contact local service providers to arrange for electricity, water, and internet services to be activated beforehand, ensuring you have everything you need from day one. This planning can help you settle in comfortably without unnecessary delays.

Lastly, take time to explore your new neighborhood. Familiarize yourself with local amenities, schools, and community resources. Acquainting yourself with your neighbors and the area can significantly enhance your living experience, helping you to integrate into your new home and foster a sense of belonging.

Review Important Documents Before Finalizing the Purchase

Before finalizing your purchase in Centurion, reviewing essential documents is critical to ensure everything is in order. Start with the sale agreement, which outlines the terms of your purchase, including the price, contingencies, and any special conditions agreed upon during negotiations. Understanding these details helps avoid misunderstandings later on.

Next, review the title deed and transfer duty receipts. These documents are vital for confirming your ownership of the property and ensuring that all transfer fees have been correctly paid. It is equally essential to ensure that there are no encumbrances or claims on the property, as this could impact your ownership rights.

Finally, confirm the home inspection report. This document delineates any identified issues with the property and serves as a basis for negotiations. Being aware of these issues allows you to ensure that any necessary repairs have been addressed before finalization, thus safeguarding your investment.

Frequently Asked Questions About Buying Entry-Level Homes in Centurion

What Is the Average Price Range for Entry-Level Homes in Centurion?

The average price of entry-level homes in Centurion typically ranges from R1.5 million to R2.5 million, depending on location and available amenities.

How Long Does the Home-Buying Process Usually Take in Centurion?

The home-buying process in Centurion can take anywhere from 2 to 3 months, influenced by various factors including financing and legal procedures.

What Are the Typical Closing Costs for Buyers in Centurion?

Typical closing costs in Centurion can range from 5% to 7% of the purchase price, encompassing transfer fees, registration fees, and legal costs.

Is It Necessary to Hire a Real Estate Agent When Buying a Home?

While it’s not obligatory, hiring a real estate agent can provide invaluable expertise, market insights, and negotiation skills, making the buying process smoother and more efficient.

Can I Negotiate the Asking Price of a Property?

Yes, negotiating the asking price is common in the property market. Having market research and data on comparable sales can significantly strengthen your negotiating position.

What Should I Do If My Offer Is Rejected?

If your offer is rejected, consider reassessing your bid and possibly increasing your offer or addressing any contingencies that may have concerned the seller.

Are There Any First-Time Buyer Grants Available in Centurion?

Various government incentives and grants are available for first-time buyers in South Africa, aimed at making homeownership more accessible and affordable.

What Is the Best Way to Prepare for a Home Inspection?

Preparing for a home inspection involves ensuring the property is accessible, addressing minor repairs, and being ready to answer questions regarding the home’s history and condition.

How Can I Improve My Chances of Securing a Mortgage?

Enhancing your credit score, reducing debt, and providing a stable income history can significantly improve your chances of obtaining a mortgage.

What Common Mistakes Should I Avoid When Buying a Home?

Common mistakes include failing to conduct thorough research, neglecting to budget for closing costs, and skipping home inspections.

Explore our content on YouTube!

The Article Negotiate Top Deals on Entry-Level Homes in Centurion: Proven Strategies First Published On: https://revolvestate.com

The Article Entry-Level Homes in Centurion: Proven Deal Negotiation Tips Was Found On https://limitsofstrategy.com