Discover the Benefits of Living in Affordable Gated Communities

What Characterizes an Affordable Gated Community?

An affordable gated community is a well-planned residential area designed to offer budget-friendly housing options while ensuring safety and security through physical barriers such as fences and gates. These communities typically fall under the management of a homeowners’ association (HOA), which oversees community maintenance and governance. The primary objective of these gated communities is to provide a secure living environment combined with essential amenities that significantly enhance residents’ quality of life. Key elements of affordable gated communities include:

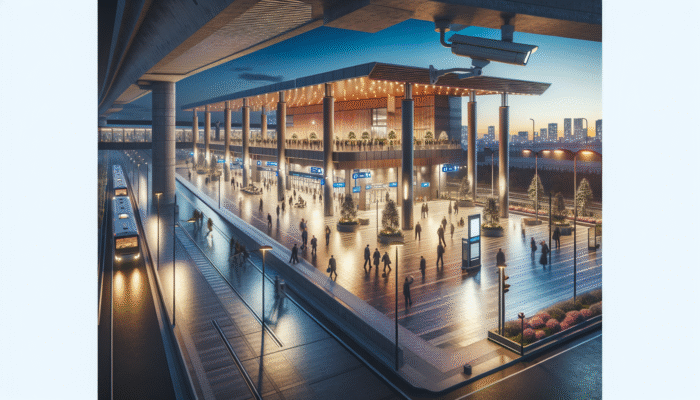

- Security Measures: Implemented access control points, vigilant security patrols, and advanced surveillance systems that enhance residents’ safety.

- Community Amenities: Shared facilities such as parks, swimming pools, and recreational spaces that promote social interaction among residents.

- Homeowner Associations: Organized management services that ensure the community’s upkeep and adherence to regulations.

- Affordability: Homes priced to meet the needs of first-time buyers and families looking for reasonable housing options.

These appealing features make gated communities particularly desirable for individuals seeking a harmonious blend of security and a vibrant community atmosphere.

Why Is Choosing to Live in a Gated Community a Wise Decision?

Choosing to reside in a gated community offers numerous benefits, especially for those entering the housing market for the first time. The enhanced security, privacy, and shared amenities create an inviting living environment that encourages social engagement among residents. Notable advantages for first-time buyers include:

- Enhanced Security: Controlled access significantly reduces crime risks, providing peace of mind for all residents.

- Community Engagement: Neighbors often participate in social events and activities, fostering strong relationships and a sense of belonging.

- Well-Maintained Surroundings: Professional management ensures cleanliness and maintenance of shared spaces, contributing to a pleasant living environment.

- Increasing Property Values: Homes in gated communities tend to appreciate at a higher rate over time, making them a smart investment choice.

These collective aspects contribute to a fulfilling lifestyle, making gated communities an exceptional selection for newcomers to the real estate market.

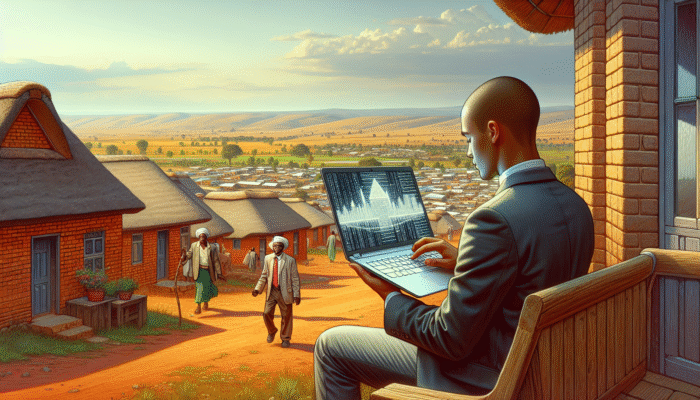

Why Is Ladysmith an Exceptional Choice for First-Time Homebuyers?

Ladysmith offers a unique opportunity for first-time homebuyers due to its affordability, rapidly developing infrastructure, and community-oriented atmosphere. The cost of living remains relatively low, allowing new homeowners to explore suitable properties without facing overwhelming financial strain. Furthermore, Ladysmith has experienced significant growth in amenities and services tailored to accommodate a diverse population. This charming town skillfully combines urban conveniences with a close-knit community vibe, making it an ideal choice for individuals entering the housing market.

Expert Recommendations on Affordable Gated Communities for First-Time Buyers in Ladysmith

What Insights Do Experts Provide About Gated Communities?

Experts frequently advocate for gated communities due to their heightened security and community-centric advantages. In Ladysmith, successful developments showcase strong security measures and vibrant communal spaces. For example, a prominent gated community in Ladysmith has implemented 24-hour security surveillance, significantly reducing crime rates and offering residents peace of mind. Additionally, these communities promote social interactions through organized events and shared amenities, fostering a welcoming environment for newcomers.

How Can First-Time Buyers Successfully Navigate the Housing Market?

Navigating the property market can be overwhelming for first-time buyers; however, understanding market trends and collaborating with seasoned real estate agents can greatly simplify this process. Initially, buyers should research local property values and market trends, which can be accomplished through online listings and community forums. Additionally, partnering with a knowledgeable real estate agent can provide access to exclusive listings and valuable insights about the best communities in Ladysmith. By taking these proactive steps, first-time buyers can make informed decisions throughout their home-buying journey.

What Key Factors Should You Assess When Choosing a Gated Community?

When selecting a gated community, it is vital to evaluate several crucial factors to ensure it aligns with your lifestyle and needs. Carefully consider elements such as security measures, available amenities, and community regulations to identify the best fit for you. Important aspects to assess include:

- Security Features: Look for comprehensive systems like CCTV and attentive security patrols that contribute to safety.

- Amenities: Examine the quality and variety of communal facilities available within the community to enhance your living experience.

- Community Regulations: Familiarize yourself with the HOA rules and guidelines to understand the community’s expectations and lifestyle.

- Location: Consider proximity to schools, shopping centers, and healthcare facilities for convenience and accessibility.

This thorough evaluation will help distinguish outstanding gated communities in Ladysmith from others, ensuring a wise and informed investment.

What Financial Aspects Should You Consider When Buying in a Gated Community?

Purchasing a home in a gated community involves specific financial considerations that buyers must understand. It is essential to identify the associated costs, such as HOA fees, maintenance expenses, and potential resale value, to make informed financial decisions. First-time buyers in Ladysmith should anticipate monthly fees that cover security and community services. While these fees may appear burdensome initially, they often lead to lower long-term maintenance costs and increased property values. Financial experts recommend calculating these expenses alongside your budget to ensure a sustainable investment in your future.

Financing Your First Home in a Gated Community

What Financing Options Are Available for First-Time Buyers?

For first-time buyers in South Africa, numerous financing solutions exist to facilitate securing a home within a gated community. Understanding these options can help ease the financial burden associated with homeownership. Notable financing pathways include:

- Government-Backed Loans: Programs like the Finance Linked Individual Subsidy Programme (FLISP) can assist eligible buyers in their home purchase.

- Private Mortgages: Traditional lenders offer competitive rates specifically aimed at first-time buyers.

- First-Time Buyer Schemes: Initiatives from banks or financial institutions designed to support new homeowners.

- Personal Savings: Utilizing savings for a larger down payment can significantly reduce monthly mortgage costs, making homeownership more achievable.

Exploring these financing options enables first-time buyers to identify the most suitable methods tailored to their unique financial circumstances and homeownership goals.

How Can You Secure the Most Competitive Mortgage Rates?

To obtain the most favorable mortgage rates, first-time buyers must engage in thorough research and financial preparation. It is crucial to compare offers from various lenders, as rates can vary significantly. Before applying for a mortgage, improving your credit score is essential; a higher credit score can lead to lower interest rates. Moreover, buyers should consider the advantages and disadvantages of fixed versus variable rates, weighing the benefits of stability against potential fluctuations in costs. Following these strategies can yield substantial savings throughout the mortgage’s duration.

What Should You Know About Down Payments and Closing Costs?

Understanding down payments and closing costs is vital during the home-buying process. Typically, down payments in South Africa range from 10% to 20% of the property’s value, and grasping this concept can assist first-time buyers in budgeting effectively. Closing costs may encompass transfer fees, attorney fees, and various other expenses that can accumulate quickly. Therefore, it is advisable for buyers to create a comprehensive budget that accounts for both down payments and additional costs, ensuring they avoid financial strain during the purchasing process.

Understanding the Advantages of Living in a Gated Community

What Enhanced Security Features Can Residents Expect?

One of the main attractions of gated communities is their enhanced security features. Most gated communities in Ladysmith are equipped with controlled access points, significantly limiting entry to authorized residents and their guests. Many also utilize security patrols and cutting-edge surveillance systems, providing an additional layer of protection for the community. The implementation of these measures has been shown to effectively decrease crime rates, offering reassurance to residents who prioritize safety.

Furthermore, the close-knit community structure fosters a sense of responsibility among residents, further enhancing the secure environment. Neighbors often look out for one another, creating a communal bond that serves as an additional deterrent against criminal activity. This collaborative approach to security represents a distinct advantage for families and individuals seeking a safe and secure living environment.

What Community Amenities and Social Opportunities Are Available?

Living in a gated community often means access to a plethora of community amenities that significantly enrich the overall quality of life. Many gated communities in Ladysmith feature shared facilities such as swimming pools, fitness centers, playgrounds, and community halls. These amenities encourage an active lifestyle and foster social interaction among residents. Regular community events, including sports days, movie nights, and barbecues, provide opportunities for neighbors to connect and build friendships.

The availability of these amenities not only enhances the living experience but also cultivates a sense of belonging. Residents can engage in various recreational activities that contribute to a healthier, more vibrant community. This community-focused lifestyle is particularly appealing to first-time buyers seeking more than just a place to live; it offers a holistic living experience that nurtures personal connections.

How Do Property Values and Resale Potential Differ in Gated Communities?

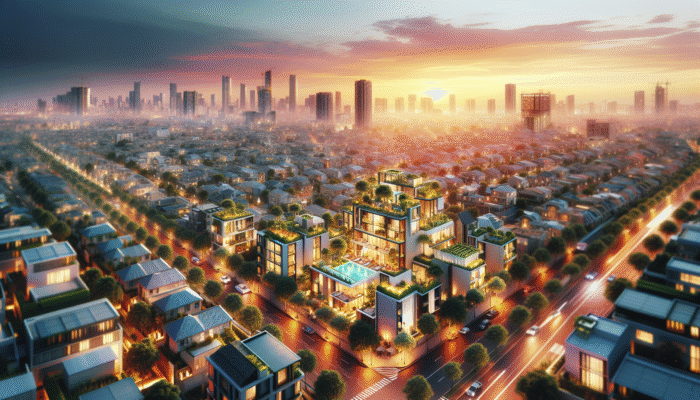

Properties located within gated communities often witness higher property value appreciation compared to homes situated in non-gated areas. The combination of enhanced security, community amenities, and a well-maintained environment tends to attract a desirable demographic of buyers, leading to increased demand. This heightened demand can significantly boost resale potential, making a home in a gated community a wise financial investment.

For first-time buyers, understanding the long-term advantages of investing in a gated community is crucial. These properties are frequently regarded as premium options, resulting in quicker sales and higher offers when the time comes to sell. Therefore, it is essential for new homeowners to consider not only their immediate living situation but also the future value of their investment in real estate.

What Levels of Privacy and Exclusivity Are Offered?

Gated communities inherently provide a level of privacy and exclusivity that many homebuyers find appealing. With restricted access, residents can enjoy a calm and serene living environment, away from the hustle and bustle of urban life. This exclusivity fosters a sense of prestige, making gated communities highly sought after by first-time buyers who desire both comfort and security.

Moreover, this privacy can significantly enhance the quality of life for residents. Families can feel secure allowing children to play outdoors, while adults can appreciate communal spaces without the intrusion of outsiders. The unique environment nurtures a close-knit community where residents often share similar values and lifestyles, further enriching the sense of belonging and community spirit.

What Maintenance and Upkeep Are Provided?

A significant advantage of residing in a gated community is the professional maintenance and upkeep provided by homeowners’ associations. These associations are responsible for maintaining common areas, landscaping, and facilities, ensuring a consistently high standard of living for residents. This collective approach to maintenance not only enhances the community’s visual appeal but also preserves property values over time.

For first-time buyers, this aspect can alleviate concerns regarding property upkeep, allowing them to focus on enjoying their new home rather than dealing with time-consuming maintenance tasks. Overall, the professional management of gated communities contributes to a pleasant living environment that residents can take pride in and enjoy.

Navigating the Home Buying Process in Ladysmith

How to Identify the Perfect Gated Community for Your Needs?

Finding the ideal gated community in Ladysmith requires thorough research and self-assessment. Begin by visiting various gated communities, attending open houses, and engaging with current residents to gain insights into the community dynamics. Key factors to consider while making your choice include:

- Location: Proximity to workplaces, schools, and essential amenities that enhance daily living.

- Community Culture: The overall atmosphere and lifestyle of residents that align with your values.

- Amenities: The quality and type of shared facilities available for residents that support an active lifestyle.

- Security Measures: Evaluate the security protocols implemented within the community to ensure safety.

By carefully assessing these elements, first-time buyers can make informed decisions that align with their lifestyle preferences and budgetary constraints, ensuring a satisfying home-buying experience.

What Steps Should You Take to Make an Offer on a Home?

Once you have identified a property in a gated community that meets your criteria, the next step is to make an offer. Start by conducting thorough research on the local market to determine an appropriate offer price that reflects the property’s value. Partnering with a real estate agent will facilitate negotiations and help secure favorable terms with the seller. This relationship can prove invaluable, as agents possess the expertise necessary to navigate the complexities of property transactions effectively.

Ensure that your offer includes conditions that protect your interests, such as a satisfactory home inspection and financing approval. This approach signals your seriousness to the seller while ensuring that you are making a sound investment in your future.

What Steps Follow After Your Offer is Accepted?

Once your offer receives acceptance, several critical steps must be undertaken to ensure a smooth closing process. Start with a comprehensive home inspection to identify any potential issues that may require attention before finalizing the sale. Engaging professionals during this phase can save you money and ensure that the home’s condition meets your expectations.

Following the inspection, it is time to finalize your financing. Confirm your mortgage details with your lender and gather any necessary documentation. Lastly, prepare for the closing process, which involves signing paperwork, paying closing costs, and officially transferring ownership. Understanding these steps will help first-time buyers feel more confident and prepared throughout this crucial phase of home buying.

Effective Strategies for First-Time Buyers in Affordable Gated Communities in Ladysmith

What Strategies Can First-Time Buyers Implement for Success?

First-time buyers can greatly benefit from various strategies aimed at maximizing their chances of success in the housing market. Saving diligently for a down payment is crucial, as this can drastically reduce monthly mortgage payments and make homeownership more achievable. Additionally, improving your credit score through responsible borrowing and timely payments can be instrumental in securing favorable mortgage rates. Conducting thorough market research in Ladysmith is equally important, as understanding local trends enables buyers to identify the most lucrative opportunities and desirable properties.

Furthermore, networking with experienced homeowners can provide invaluable insights into the buying process and community life, helping to build confidence and knowledge. These strategies empower first-time buyers to navigate their home-buying journey more effectively, ensuring a successful investment in their future.

How Can You Maximize Your Investment in a Gated Community?

Maximizing your investment in a gated community involves several strategic approaches. Firstly, it is essential to select a community with strong growth potential; search for areas undergoing development or revitalization to ensure your investment appreciates over time. Maintaining the property is equally important; regular upkeep enhances your living experience and boosts future resale value. Additionally, understanding local market trends will aid buyers in making informed decisions about renovations or upgrades that could enhance property value and desirability.

Engaging with community initiatives and participating in local events can further amplify your investment by building relationships with neighbors and contributing to a vibrant living environment. By taking these proactive measures, first-time buyers can ensure that their investment in a gated community yields substantial benefits over time.

What Are the Long-Term Advantages of Living in a Gated Community?

The long-term advantages of residing in a gated community are numerous and multifaceted. Over time, properties in these communities typically appreciate at a faster rate than those in non-gated areas, providing homeowners with significant financial benefits. The enhanced security and community atmosphere contribute to a strong sense of belonging and stability, particularly appealing for families seeking a nurturing environment.

Moreover, living in a gated community fosters social ties and networks that can serve as a support system for residents. By leveraging these long-term benefits, first-time buyers can enjoy a fulfilling lifestyle while ensuring their investment remains solid for years to come, ultimately enhancing their quality of life.

Exploring Lifestyle and Amenities in Ladysmith’s Gated Communities

What Types of Amenities Are Typically Available in Gated Communities?

In Ladysmith’s gated communities, residents can take advantage of a variety of amenities that enrich their quality of life. Common offerings include swimming pools, fitness centers, playgrounds, walking trails, and community parks that encourage outdoor activities and promote a healthy lifestyle. These facilities provide ample opportunities for physical activity and social interaction, contributing to a vibrant community atmosphere.

Additionally, many gated communities organize events and activities that engage residents and foster a strong sense of belonging. Seasonal festivals, sports leagues, and community clean-up days create opportunities for residents to connect with one another and strengthen community ties. The combination of these amenities and activities helps cultivate a fulfilling lifestyle for families and individuals alike, making gated living truly rewarding.

In What Ways Does the Community Lifestyle Benefit Residents?

The community lifestyle within gated developments offers numerous advantages to residents. A primary benefit is the strong sense of safety and security that these communities provide. Many residents feel more comfortable allowing children to play outside or engaging in outdoor activities without the fear of external threats. This environment fosters a familial atmosphere, enhancing overall happiness and well-being among residents.

Moreover, the shared amenities and communal activities encourage social connections among neighbors, leading to lasting friendships and support networks that enrich residents’ lives. Overall, the community lifestyle in gated areas contributes to a higher quality of life and a more fulfilling existence for all residents, creating a nurturing environment for families and individuals alike.

What Activities Are Available for Residents to Enjoy?

Residents of gated communities in Ladysmith enjoy a plethora of engaging activities designed to promote well-being and social interaction. Common activities include organized sports leagues, community gatherings, fitness classes, and family events such as barbecues and holiday celebrations. These activities not only promote physical health but also foster camaraderie among residents, strengthening community bonds.

Additionally, many communities offer recreational programs for children, enhancing their development and social skills. By participating in these activities, residents can enjoy a vibrant lifestyle, forge connections, and create lasting memories with their neighbors, enriching their overall living experience.

How Do Affordable Gated Communities Influence Local Economies?

What Economic Benefits Can Gated Communities Bring to Local Areas?

Affordable gated communities can significantly stimulate local economies. These developments create jobs during both the construction phase and ongoing maintenance, positively impacting employment rates in the area. Furthermore, the influx of new residents can lead to increased demand for local goods and services, benefiting businesses in the vicinity and contributing to economic growth.

As property values rise within gated communities, local governments benefit from higher tax revenues, which can be reinvested into public services and infrastructure. This economic growth supports the community while enhancing the overall quality of life for local residents, creating a win-win situation for everyone involved.

How Do Gated Communities Impact Property Values in Surrounding Areas?

The presence of gated communities can profoundly affect property values in surrounding areas. As demand for homes in gated developments rises, neighboring properties often experience an increase in value due to enhanced perceptions of safety and desirable living conditions. This positive ripple effect can benefit existing homeowners while attracting new buyers to the region, ultimately revitalizing the local real estate market.

Real estate experts have noted that properties located near gated communities often appreciate faster, making them a sound investment for homeowners. This positive influence on local property values contributes to the overall economic vitality of the area and enhances the attractiveness of the community.

What Challenges and Solutions Exist for Local Economies?

While gated communities bring numerous benefits, they also present specific challenges to local economies. One significant concern is the potential for gentrification, which can lead to the displacement of long-standing residents as property values rise. Additionally, increased population density can strain local infrastructure and resources, such as schools and public transport systems.

To address these challenges, community engagement and sustainable development practices are essential. Local governments and community leaders should collaborate to ensure that growth is managed equitably and that infrastructure keeps pace with new developments. By fostering open communication and cooperation among stakeholders, communities can mitigate potential downsides while maximizing the benefits of gated living, ultimately leading to a thriving environment.

Future Trends and Developments in Ladysmith’s Gated Communities

What Emerging Trends Are Shaping Gated Living?

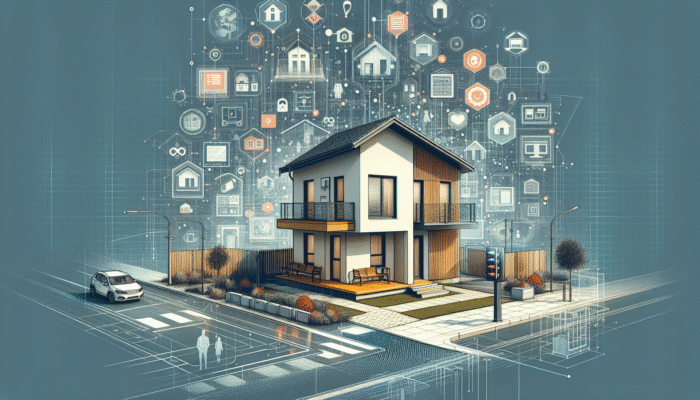

Emerging trends in gated living reflect a shift towards sustainability, technological integration, and community wellness. Many developments are beginning to adopt eco-friendly building practices and energy-efficient technologies to meet the growing demand for sustainable living options. Additionally, smart home technology is becoming increasingly prevalent, enabling residents to manage their homes remotely and enhance security measures.

Furthermore, there is a growing emphasis on wellness-oriented amenities, including fitness centers and walking trails, that promote healthy living. Communities prioritizing these trends are likely to attract a diverse range of residents, including health-conscious individuals and families. As the demand for these features continues to rise, Ladysmith’s gated communities will evolve, aligning with the changing preferences of homebuyers and enhancing the overall living experience.

How Might Future Developments Benefit First-Time Buyers?

Future developments in Ladysmith’s gated communities may provide more affordable options and innovative financing solutions tailored specifically for first-time buyers. As the market adapts to the needs of younger generations, we can expect a diversification of housing types and price points, making homeownership more accessible than ever. Moreover, the incorporation of technology and community-focused amenities will enhance the living experience for residents, creating a more fulfilling environment.

These trends are advantageous for first-time buyers, as they will offer a broader spectrum of choices while promoting a sense of belonging and community engagement. By staying informed about these developments, prospective homeowners can make strategic decisions that align with their goals and preferences, ensuring a satisfying home-buying journey.

What Developments Can We Anticipate in the Coming Years?

In the coming years, Ladysmith is poised for significant growth in gated communities, with a focus on sustainability, technology, and community engagement. As more buyers recognize the advantages of gated living, the demand for these developments is likely to increase, leading to the construction of new projects that cater to diverse demographics and lifestyle preferences.

Additionally, existing communities may undergo renovations and upgrades to meet evolving preferences, ensuring they remain competitive in the housing market. This dynamic landscape will ultimately provide first-time buyers with more choices and opportunities, enhancing their overall home-buying experience and contributing to a thriving community.

Frequently Asked Questions

What is a gated community?

A gated community is a residential area enclosed by a physical barrier, providing controlled access and enhanced security for its residents, ensuring peace of mind.

Are gated communities safe?

Yes, gated communities typically offer enhanced security measures such as guard patrols and surveillance systems, contributing to a safer living environment for all residents.

What costs are associated with living in a gated community?

Costs may include monthly homeowners’ association (HOA) fees, property taxes, and maintenance expenses, which can vary based on the community and its amenities.

Can I find affordable homes in gated communities?

Yes, many gated communities provide budget-friendly options tailored to first-time buyers while offering the benefits of secure living and community engagement.

How can I find a gated community in Ladysmith?

Researching online property listings, visiting local real estate agents, and attending open houses can help you discover gated communities in Ladysmith that meet your needs.

What amenities are typically available in gated communities?

Common amenities include swimming pools, fitness centers, parks, walking trails, and community centers that foster a sense of community and enhance residents’ quality of life.

Is it worth investing in a gated community?

Investing in a gated community can be worthwhile due to potential property value appreciation, enhanced security, and a higher quality of life for residents.

What financing options are available for first-time buyers?

First-time buyers can access government-backed loans, private mortgages, and first-time buyer schemes to assist with their home purchase, making homeownership more accessible.

How does living in a gated community affect property values?

Properties in gated communities often appreciate faster than those in non-gated areas, contributing to better resale potential for homeowners and a vibrant real estate market.

What should I consider before buying in a gated community?

Consider factors such as security features, community rules, available amenities, and location when deciding on a gated community to ensure it aligns with your lifestyle and preferences.

Explore our content on YouTube!

The Article Affordable Gated Communities for First-Time Buyers in Ladysmith: Your Dream Home Awaits First Published On: https://revolvestate.com

The Article Affordable Gated Communities for First-Time Buyers in Ladysmith Was Found On https://limitsofstrategy.com